A-Level经济学课程知识点非常多,需要考生逐个掌握,比如下面新航道重庆学校alevel老师讲解的Price elasticity of demand and Incidence of tax。在讲解Incidence of tax之前,我们需要学习有关Price elasticity of demand的相关知识点。

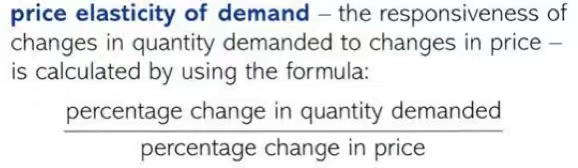

有的学生就会问了,什么是elasticity呢?Elasticity is a measur of how much the quantity demanded is affected by changes in price,income or other factors.So price elasticity of demand measure the responsiveness of quantity demanded to changes in the price of the good。根据PED的定义,可以得到一个关于PED的公式:

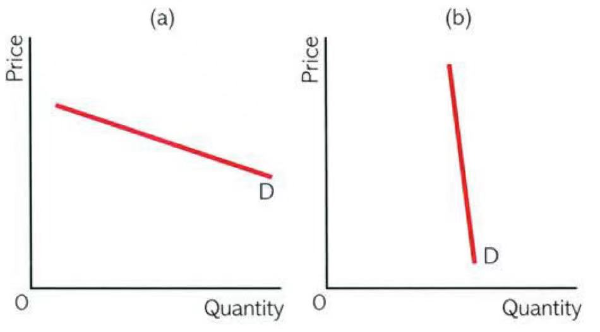

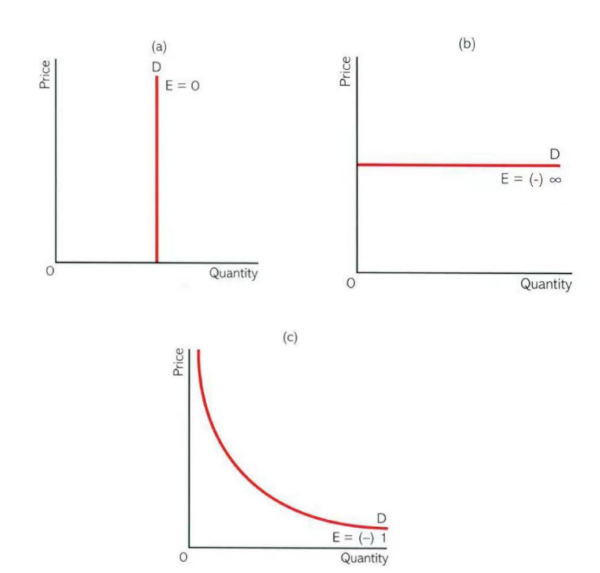

那么当价格变化时,需求数量的变化到底是怎么变化的呢。根据PED的定义和公式,大致分为五类:elastic、inelastic、perfectly inelastic、perfectly elastic、unitary elasticity,每种类型都会对应有相关的函数图像。

Figure(a)shows an elastic demand curve.figure (b)shows an inelastic demand curve.对于弹性商品而言,商家可以降低价格获得更高利润,因为从图像能明显看出,只需要降低一点价格,就能带来更多的需求数量。

A vertical demand curve(a)is perfectly inelastic,while a horizontal demand curve(b)is perfectly elastic. A curve with unitary elasticity (c)is a rectangular hyperbola with the formula PQ=K where P is price,Q is quantity demanded and K is a constant valve.这五个图像以及对应PED的范围是常考题哦,所以需要去认真掌握哦。

那么哪些因素可以影响到PED呢?

1、The availablility of substitutes. The better the substitutes for a product ,the higer the price elasticiy of demand will tend to be.For instance,salt has few good substitutes,when the price of salt increases,price elasticity of salt will change little and therefore the good substitutes.

2、Width of market definition. The more widely the product is defined,the fewer substitutes it is likely to have.Pasta has many substitutes,but food in general has none.Therefore the elasticity of demand for pasta is likely to be higher than that for food.

3、Time. The longer the perid of time,the moer price elastic is the demand for a product.For instance,in 1937-74 when oil prices increased by four times,the demand for oil was initially little affected.

了解完Price elasticity of demand过后,我们再来学习有关税收分配。同学们,有没有想过这样一个问题:当政府对生产者进行征税时,是由谁承担了这部分的税呢?

其实这个问题是CIE考试中的一个难点,因为这里面涉及到了供给和需求、PED、PES的内容,也是很多同学较为头疼的一个重要知识点。下面跟我一起来学习Incidence of tax吧!!!

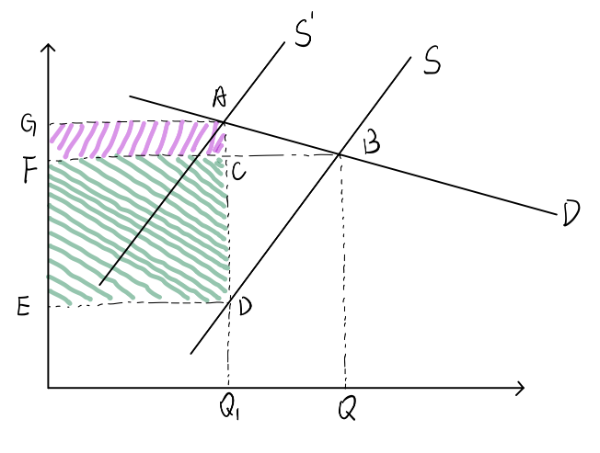

首先,我们要知道,当政府对生产者征税时,每单位商品的0增加,所以会导致供给曲线左移(非价格因素的影响),那么equilibrium price就会发生变化,如下图所示

S曲线左移过后,会与原来的D曲线交与A点,那么equilibrium price就由F点升高为G点,所对应的原S曲线为价格E。

四边形GADE的面积就代表了政府的tax revenue

四边形GACF的面积代表了由消费者承担的税收

四边形FCDE的面积代表了由生产者承担的税收

很明显由生产者承担的税收大于消费者承担的税收

但是,是不是所有的情况都是生产者承担的税收要多些呢?

从这张图就能明显的看出:

四边形GADE代表政府的tax revenue

四边形GACF代表消费者承担的税收

四边形FCED代表生产者承担的税收

那为什么这两个图所代表的结果不一样呢?仔细观察,图一的S曲线陡峭一些,图二的S曲线平坦一些。根据PES的函数图像来分析,图一是PED具有弹性(需求曲线较平坦),图二是PES更具有弹性(供给曲线较平坦)。

所以我们可以得出一个非常重要的结论:

If supply is elastic or demand inelastic,the incidence of tax will fall more on consumers;

If suppy is inelastic or demand elastic,the incidence of tax will fall more on producers.